50/30/20 Budget Rule: How It Works, Examples, and a Simple Calculator

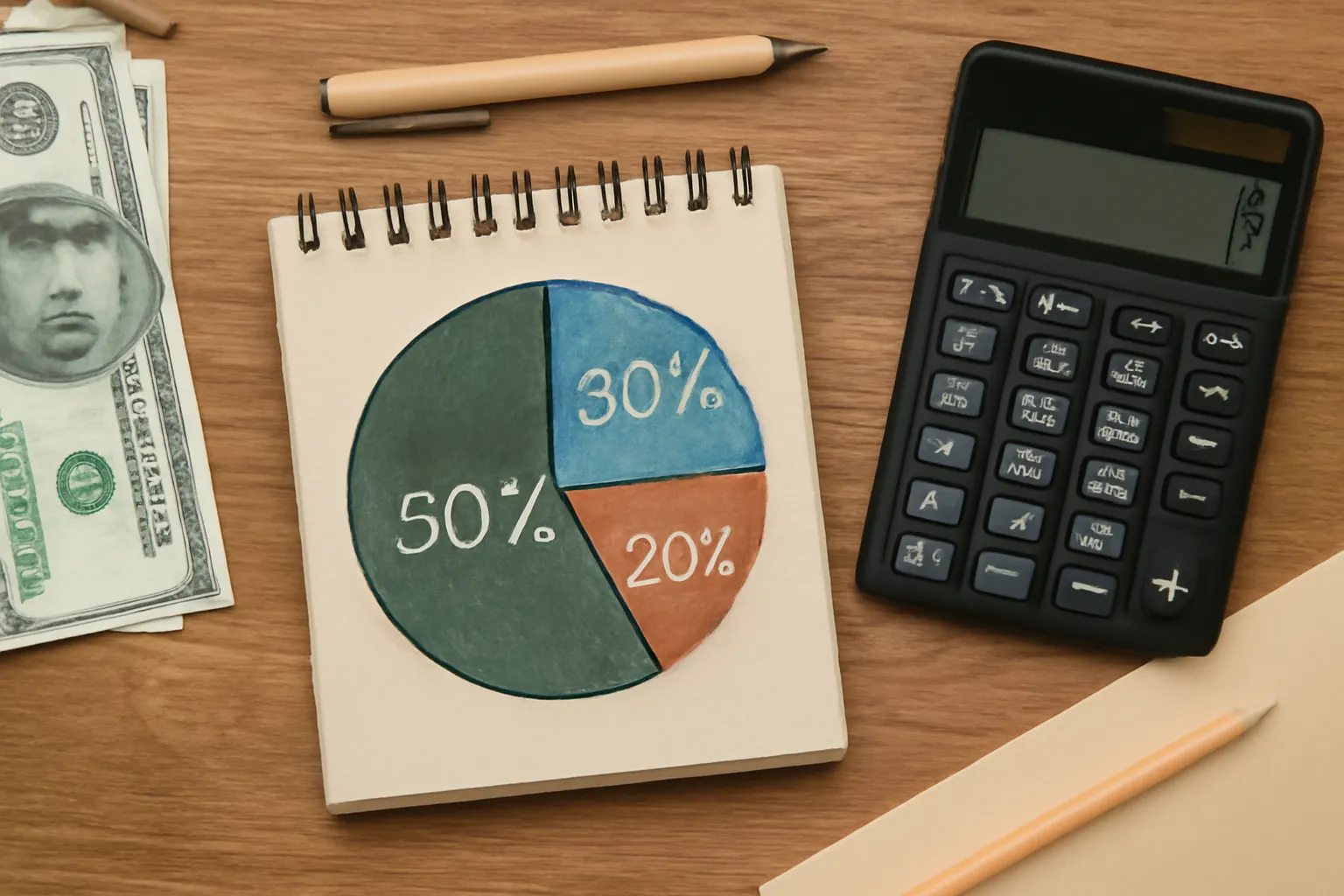

The 50/30/20 budget rule—also called the 50-30-20 method, the fifty-thirty-twenty rule, or the 50/20/30 budget rule—is a straightforward money management framework that divides your after-tax income into three buckets: Needs (50%), Wants (30%), and Savings & Debt Repayment (20%). Popularized by Senator Elizabeth Warren and Amelia Warren Tyagi in “All Your Worth,” this framework has stayed relevant because it’s easy to remember, quick to implement, and flexible enough to fit many lifestyles.

In this comprehensive guide, you’ll learn how the 50/30/20 budgeting rule works, get clear examples for different incomes and life situations, and use a lightweight calculator to model your own numbers. You’ll also discover practical adjustments, mistakes to avoid, and alternatives like 60/30/10 or 70/20/10 that may suit your goals even better.

What Is the 50/30/20 Budget Rule?

The 50/30/20 rule of budgeting is a heuristic—an easy rule of thumb—to help you prioritize your spending and saving without needing a complicated spreadsheet. It’s not about eliminating fun or micromanaging every dollar; it’s about creating a resilient structure so that necessities are covered, lifestyle choices are intentional, and future-you is funded.

The Three Buckets Explained

-

50% for Needs: Essential expenses required to maintain your basic standard of living. These are the bills that keep the lights on and the roof over your head.

- Housing (rent or mortgage, basic utilities)

- Transportation to work or school (car payment, gas, transit pass)

- Groceries (core food staples, not dining out)

- Insurance (health, renters, auto; premiums and core coverage)

- Minimum debt payments (student loans, credit cards, auto)

- Essential childcare and healthcare

-

30% for Wants: Lifestyle choices that improve comfort and enjoyment but aren’t strictly necessary to function.

- Dining out, coffee shops, entertainment, streaming

- Travel and vacations

- Shopping beyond essentials (fashion, gadgets, hobby gear)

- Premium phone plan upgrades, premium software tiers

- Gym memberships beyond basic health needs

-

20% for Savings & Extra Debt Payments: Your future and your financial resilience.

- Emergency fund contributions

- Retirement (401(k), IRA, pension buy-ins)

- Investing (brokerage accounts, long-term goals)

- Extra payments above minimums on high-interest debt

- Short-term “sinking funds” (e.g., car repairs, holiday gifts)

A key insight: Minimum debt payments belong to Needs because they’re mandatory. Extra debt payments made to accelerate payoff belong in the 20% Savings/Debt bucket.

How the 50/30/20 Method Works Step by Step

-

Calculate your after-tax income.

- For W-2 employees: Take-home pay after taxes, healthcare premiums, and retirement contributions deducted from your paycheck.

- For freelancers: Subtract business expenses and set aside estimated taxes first. The leftover is your usable after-tax income.

- For variable income: Use a conservative average of the last 6–12 months or your lowest typical month to set a baseline.

-

Multiply by the 50/30/20 percentages.

- Needs = 50% × after-tax income

- Wants = 30% × after-tax income

- Savings & Extra Debt = 20% × after-tax income

- Map each expense into the correct bucket. If you’re unsure, ask: “If I lost my job, would I still pay this?” If yes, it’s likely a Need. If it can pause without major harm, it’s probably a Want. Anything that builds wealth or eliminates debt faster goes in Saving/Debt.

-

Automate and track.

- Set up automatic transfers to savings and investments right after payday.

- Use separate checking accounts or sub-accounts labeled “Needs,” “Wants,” and “Savings.

- Track at least weekly to stay ahead of drift and mid-month surprises.

- Adjust as reality intrudes. If your rent or insurance forces Needs above 50%, compress Wants first, then evaluate long-term changes (roommates, location, transportation trade-offs).

The beauty of the 50-30-20 budget rule is that it’s simple, flexible, and goal-directed. It’s not a rigid law; it’s a guidepost.

Try the 50/30/20 Budget Calculator

Use this quick calculator to allocate your monthly take-home pay. You can also tweak the percentages to try alternatives like 60/30/10 or 70/20/10.

Needs: $2000.00

Wants: $1200.00

Savings & Extra Debt: $800.00

Tip: If your minimum debt payments exceed the Needs amount, reduce Wants and reallocate part of Savings/Debt to cover essentials. Then plan a longer-term fix (refi, negotiate, downsize).

Detailed Examples Using the 50-30-20 Rule

Example 1: Single Professional, $4,000 Monthly Take-Home

- Income: $4,000/month

- Needs (50%): $2,000

- Rent and utilities: $1,350

- Groceries: $320

- Transit pass: $90

- Insurance (health/auto/renters): $180

- Minimum student loan payment: $60

- Wants (30%): $1,200

- Dining/coffee: $250

- Dining/coffee: $250